The Finance Ministry recently announced a major milestone for the Atal Pension Yojana (APY) with over 7.15 crore subscribers enrolled under the scheme till December 2, 2024.

Highlighting the success of the program, the ministry tweeted, “Atal Pension Yojana with over seven crore subscribers under #APY, offers a secure retirement with guaranteed #PensionBenefits, ensuring peace of mind post retirement to its beneficiaries.”

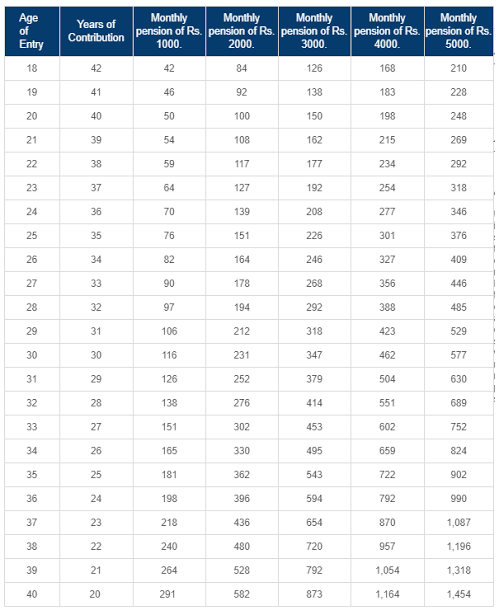

Launched to provide financial security to India’s working population in the post-retirement years, APY guarantees a minimum monthly pension of Rs 1,000 to Rs 5,000 from the age of 60 depending on the contributions made by the subscriber.

The scheme witnessed significant participation from women who accounted for 47 per cent of the total subscribers.

A unique feature of APY is its comprehensive pension structure. After the death of the subscriber, the spouse continues to receive the same pension.

On the death of both the subscriber and the spouse, the accumulated pension corpus up to the age of 60 is returned to the nominee, ensuring longevity.

The process to apply for the Atal Pension Yojana (APY)

Eligibility Criteria:

- Age 18 to 40 years old.Must have a savings bank account (any Indian citizen can open one).

- Should not be part of any other social security scheme.

Documents Required

- Aadhaar Card:Fill out the application form with details like:For identification and account linking.

- Savings Bank Account Details: Existing account is mandatory.

- Mobile Number: Registered for communication.

- Nominee Details: For pension benefits after the subscriber’s demise.

- Name date of birthDesired pension plan (₹1,000 to ₹5,000 monthly).

- Submit the form and set up an auto-debit mandate for monthly contributions.

- A confirmation will be sent to your registered mobile number.

Offline Process:

Visit your bank branch where you have a savings account.

- Request an APY registration form.Fill out the form with accurate details, including the pension amount you wish to receive after 60 years.

- Submit the form along with a photocopy of your Aadhaar card and other required documents.

- Authorize the bank for an auto-debit of the contribution amount.

Contribution Details

- The amount you need to contribute monthly depends on your age and the desired pension.

- Contributions are auto-debited from your account until you turn 60.5.

Check Application Status

After applying, you can track the status through your bank or the NSDL e-Gov portal.

Read more👇

https://everydaytrends.in/gruhalakshmi-15-th-installment-credited/