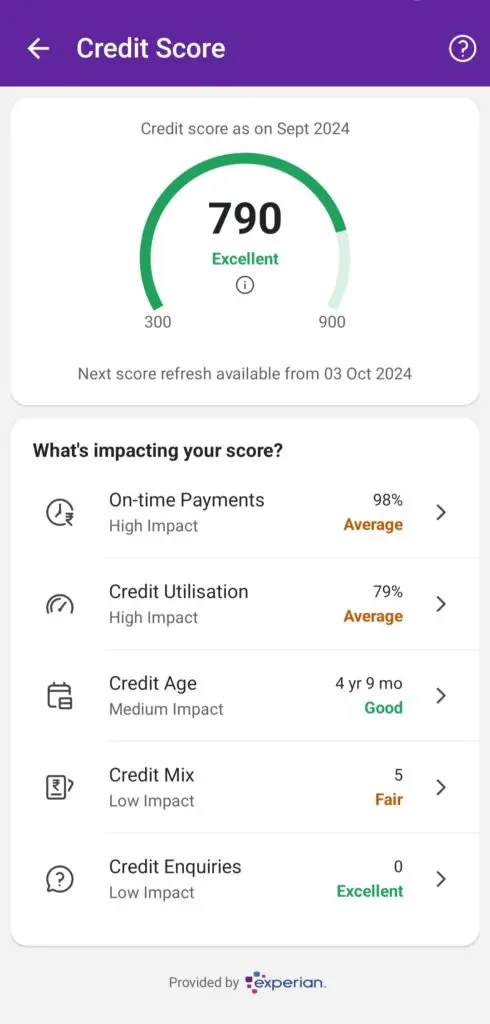

Check Cibil score is a numerical representation of a person’s credit worthiness. It typically ranges from 300 to 850, with higher scores indicating better credit. Lenders, such as banks and credit card companies, use credit scores to assess the risk of lending money to a borrower.

The score is calculated based on factors like payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries.

A good credit score can lead to better interest rates on loans, higher credit limits, and easier approval for credit cards or mortgages. Conversely, a low credit score may result in higher interest rates, lower credit limits, or even denial of credit.

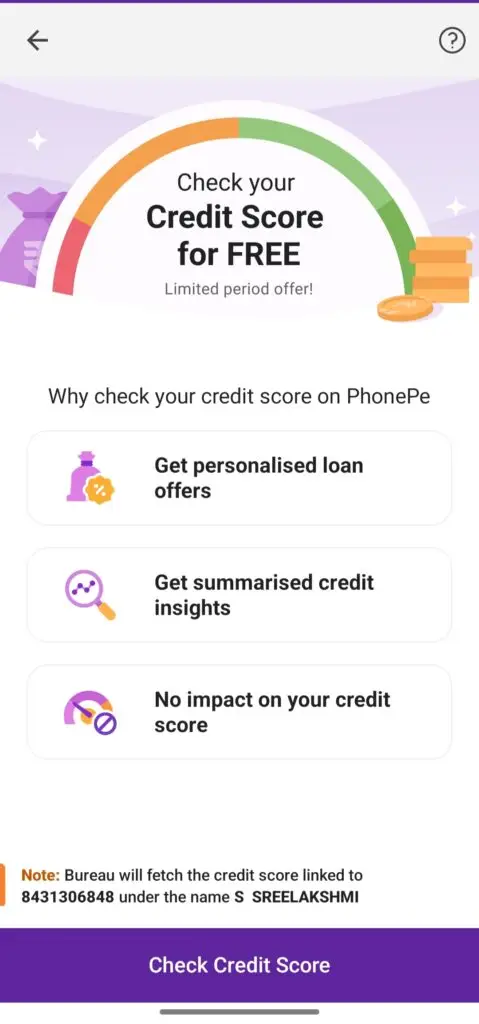

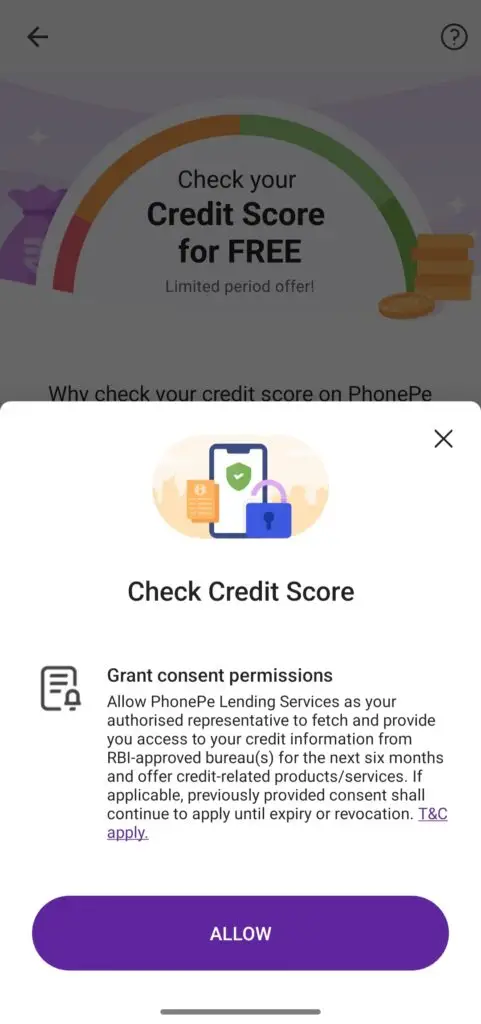

Steps to check cibil score for free

Use phone pay app to check your Cibil score without any opt

https://play.google.com/store/apps/details?id=com.phonepe.app

700 above is considered to be good cibil score to get loans easily.

Read more👇

https://everydaytrends.in/web-stories/how-to-apply-for-government-schemes-easily/