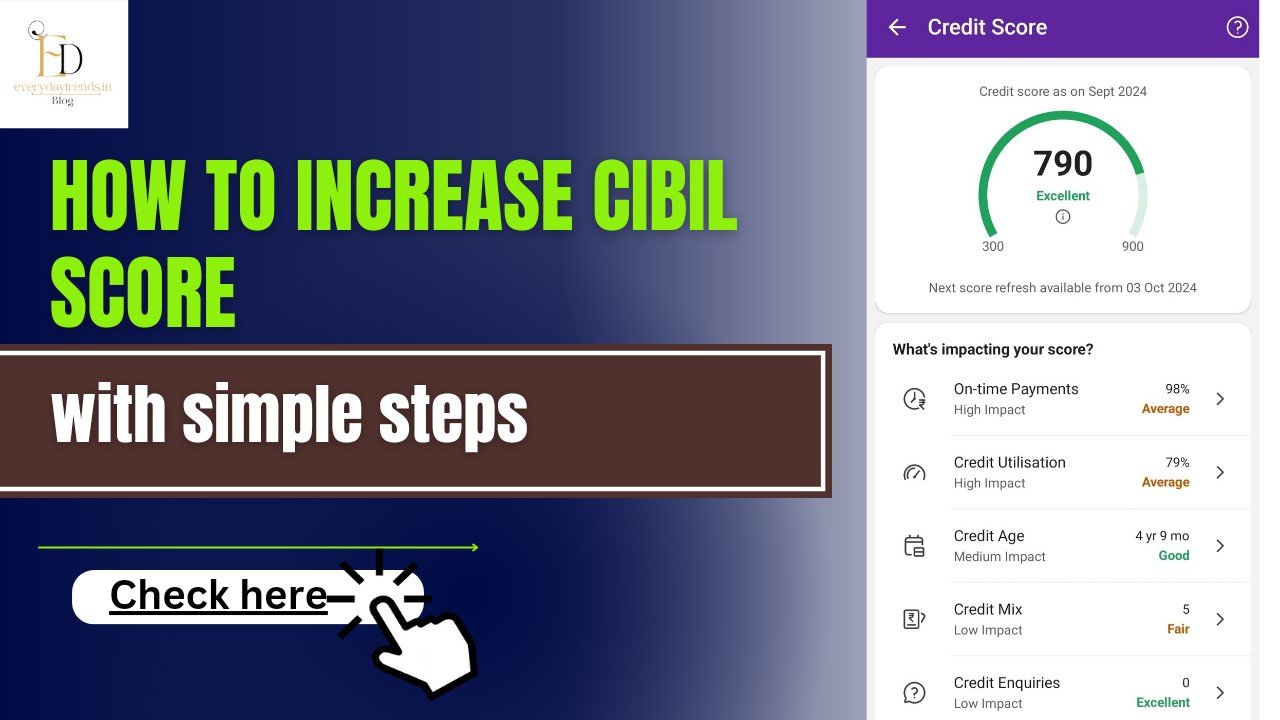

A credit or cibil score is a numerical representation of a person’s creditworthiness. It typically ranges from 300 to 850, with higher scores indicating better credit.

Lenders, such as banks and credit card companies, use credit scores to assess the risk of lending money to a borrower.

Main points to Remeber to Increase your Cibil Score

- Get Credit card : By using credit card and repaying the card bill on time can help th increase the cibil score and recover the negative points.

- Increase the score like this Don’t Overdraw: To maintain a healthy CIBIL score, don’t overdraw your credit card limit and keep your credit utilization ratio in check. Keep below 30. For this one can try to increase the credit card limit.

- Pay your bills correctly: Payment history is the most critical factor in determining your credit score. Pay your EMIs and credit card bills regularly. Do not avoid or delay this for any reason.

- Check: Check your CIBIL score regularly. This will tell you what level you are at. The score can be easily checked in the UPI application.

- Diversify your loan portfolio: A balanced mix of secured and unsecured loans can improve your credit score.

- Do not apply for different loans: Do not apply for different loans or credit cards in a short span of time. Also, make sure that your check does not bounce for any reason

Advantages

Following are the benefits if you have a high cibil score. Low interest rate on loans Increase in loan amount A longer or more flexible repayment period Quick loan sanction Wide selection of lending institutions.